Mergers and acquisitions is a critical component of any company's strategic toolkit. M&A is a competency that can be learned, practiced and developed into a competitive strategic advantage for those companies where growth is a key objective. However, M&A is a complex, multi-faceted process that presents a myriad of challenges, even for experienced practitioners. Join us in this follow-up to Professor Matti Suoninen's "Creating Value Through Mergers and Acquisitions", as we discuss a selection of best practices for acquirers and how they are implemented in actual transactions.

Mergers and acquisitions is a critical component of any company's strategic toolkit. M&A is a competency that can be learned, practiced and developed into a competitive strategic advantage for those companies where growth is a key objective. However, M&A is a complex, multi-faceted process that presents a myriad of challenges, even for experienced practitioners. Join us in this follow-up to Professor Matti Suoninen's "Creating Value Through Mergers and Acquisitions", as we discuss a selection of best practices for acquirers and how they are implemented in actual transactions.

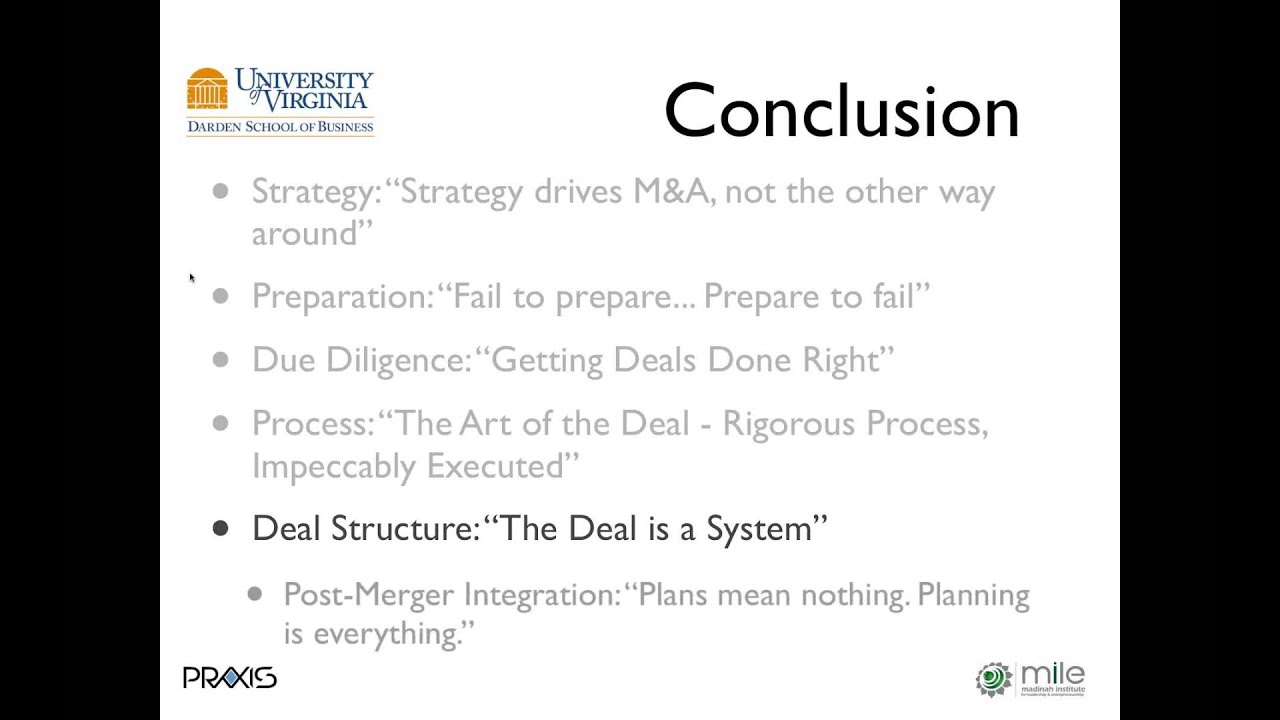

What are the key components of the acquisition process?

What are the key considerations that you should ensure are part of your acquisition plan?

How can you maximize the likelihood of success of your acquisition strategy?

About the Speaker

Dr. Michael J Ho

Darden Business School

Michael Ho is a founder and managing director of Praxis Partners, LLC,a financial advisory firm focused on providing mergers and acquisitions advisory services to middle-market companies and custom executive education programs for financial institutions. Prior to co-founding Praxis Partners and its predecessor company, he was a principal in mergers and acquisitions and director of Asia-Pacific investment banking at Robertson Stephens & Company, a leading financial advisor to emerging growth companies in the high-technology, health care and consumer products and specialty retailing industries. Before joining Robertson Stephens, he was in the mergers and acquisitions department at the First Boston Corporation under the direction of Bruce Wasserstein and Joe Perella.

Michael has developed and delivered custom education programs in the area of corporate finance, valuation, mergers and acquisitions, and corporate strategy. Past executive education clients include Standard Chartered Bank, Bank of America, NationsBank, Wachovia, Fifth Third Bank, Robertson Stephens, Montgomery, SNL Financial, GE Nuclear and EMC.

Michael is the Morris Cohen Chair of Consumer Credit and Professor of Practice at the Darden Graduate School of Business and has also served as a professor of finance at Babson College and Butler University, teaching courses in financial statement analysis, enterprise valuation, corporate restructuring and investment banking; he is currently a director of the Telamon Corporation and FibroChem, LLC. For more videos

http://www.youtube.com/user/milemadin...

- Follow Us on

https://www.facebook.com/milemadinah

https://plus.google.com/+MileMadinah

http://www.linkedin.com/company/milem...

Google+

https://plus.google.com/+MileMadinah

http://www.instagram.com/mile_madinah

Best Practices in Acquisition Strategy by Dr. Michael J. Ho of Darden Business School - MILE Webinar | |

| 60 Likes | 60 Dislikes |

| 13,261 views views | 3,625 followers |

| Education | Upload TimePublished on 16 Feb 2013 |

Không có nhận xét nào:

Đăng nhận xét